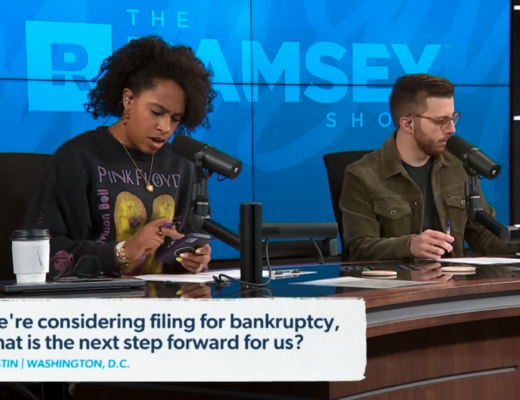

Financial mistakes in our early twenties can feel overwhelming, especially when carrying our weight alone. As someone who regularly analyzes personal finance situations, I recently encountered a story that deeply resonated with me – a young woman’s struggle on the Ramsey Show with debt and the emotional burden of keeping it hidden from her family.

Financial missteps, particularly in youth, are more common than we might think. Through my analysis of this situation, I’ve identified several crucial insights about debt, family dynamics, and the emotional weight of financial secrets that could help others in similar situations.

The Hidden Cost of Financial Secrets

When examining cases of hidden debt, I’ve noticed that the emotional toll often exceeds the financial burden. Take the case of a 22-year-old who accumulated $37,000 in debt while living with an ex-partner. Despite successfully paying down $7,000-8,000 of this debt, she carries a heavy emotional burden by keeping this information from her parents.

The situation highlights a common pattern I’ve observed: young adults often hide financial struggles from their parents out of fear of disappointment or judgment. While understandable, this secrecy can create additional stress and prevent us from receiving potential support or guidance.

Understanding the Root Causes

In analyzing this situation, several key factors emerged that often contribute to young adult debt:

- Joint financial accounts with romantic partners without clear boundaries

- Lack of experience in managing shared finances

- Working excessive hours (60+ per week) while losing track of spending

- Emotional decision-making around money management

These factors often combine to create financial vulnerability, especially in young adults just learning to navigate independent living and relationships.

The Transition to Adult Child-Parent Relationships

One of the most significant challenges I’ve identified is developing the parent-child relationship into an adult-to-adult dynamic. This transition often involves:

- Developing open communication about financial matters

- Setting appropriate boundaries while maintaining transparency

- Balancing independence with family support systems

- Managing parental concerns while maintaining autonomy

Breaking Free from Financial Shame

Through my analysis, I’ve concluded that the path to financial healing often requires addressing both practical and emotional aspects. Debt is not a moral failing — it’s a financial situation that can be resolved with the right approach and mindset.

“You may have made mistakes with your money, but you are not a mistake. You are not a problem. You are not a burden.”

This perspective is crucial for anyone working to overcome financial challenges. The guilt and shame associated with debt can be paralyzing, but they serve no constructive purpose in the recovery process.

Practical Steps for Financial Transparency

Based on my experience, I recommend the following approach to sharing financial information with family:

- Start with general information rather than specific numbers

- Focus on your action plan rather than past mistakes

- Share your progress and commitment to financial responsibility

- Set clear boundaries about the level of detail you’re comfortable discussing

Remember, you can maintain a close relationship with your family without sharing every financial detail. The key is finding the right balance between transparency and personal privacy.

Moving Forward with Confidence

Financial recovery is as much about emotional healing as it is about paying down debt. I’ve observed that successful financial turnarounds typically involve:

- Acknowledging past mistakes without letting them define you

- Creating clear, actionable plans for debt reduction

- Building support systems while maintaining independence

- Developing healthy boundaries in financial relationships

The journey to financial wellness is rarely linear, but with determination and the right support system, it’s absolutely achievable. Remember that your current financial situation is a chapter in your story, not the entire book.

Frequently Asked Questions

Q: Should I tell my parents about my debt?

The decision to share financial information with parents is personal. Consider sharing general information about your situation if you believe it would strengthen your relationship or if they could provide valuable support or guidance. You don’t need to share specific numbers unless you’re comfortable doing so.

Q: How can I maintain independence while living with family?

Establish clear boundaries, contribute to household expenses if possible, and maintain open communication about expectations. Being transparent about your financial goals and progress can help create a more adult-to-adult dynamic with your parents.

Q: What’s the best way to recover from financial mistakes made in your early 20s?

Focus on creating a solid debt repayment plan, learning from past experiences, and avoiding self-judgment. Track your progress, celebrate small wins, and remember that many successful people have overcome similar financial challenges in their youth.

Q: How do I handle financial conversations with family members who have different views on money?

Acknowledge their perspective while maintaining your financial independence. You can listen to their concerns and advice without following their suggestions. Focus on finding common ground while staying true to your financial goals and values.