Gold prices are under scrutiny as investors and economists analyze whether the precious metal can effectively serve as a

hedge against inflation. The latest market data from August 7, 2025, provides fresh insights into this traditional safe-haven asset’s performance.

As inflation concerns persist across global economies, many investors have turned to gold as a potential

store of value. The metal has historically been viewed as protection during periods of currency devaluation and rising consumer prices.

Current Market Performance

On August 7, 2025, gold showed notable price movements that analysts are carefully examining. While specific price points fluctuate throughout trading sessions, the overall trend indicates how the metal is responding to current economic conditions.

Market analysts point out that gold’s performance must be viewed in context with other economic indicators. Consumer price index reports, central bank policies, and geopolitical tensions all influence the effectiveness of gold as an inflation hedge.

The relationship between

gold and inflation isn’t always straightforward,” explains one market observer. “Sometimes gold anticipates inflation before official numbers show it, while other times it lags behind broader market movements.”

Historical Context

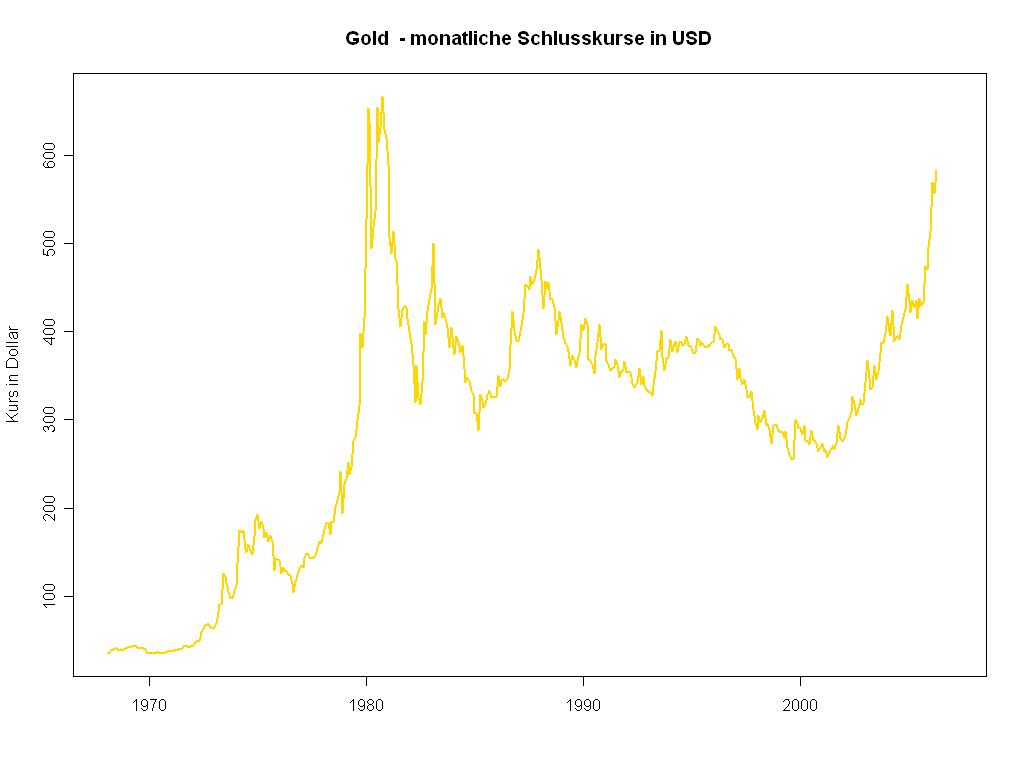

Gold’s reputation as an inflation hedge stems from its performance during previous economic downturns. During the high inflation period of the 1970s,

gold prices increased dramatically, outpacing inflation rates and providing investors with real returns.

However, this relationship hasn’t been consistent across all economic cycles. During some inflationary periods, gold has underperformed compared to other asset classes like

stocks or real estate.

The current price trends must be analyzed against these historical patterns to determine if gold is maintaining its traditional role in

investment portfolios.

Factors Affecting Gold’s Value

Several key factors are currently influencing gold prices:

- Interest rate policies from major central banks

- Strength or weakness of the U.S. dollar

- Overall market sentiment and risk appetite

- Physical demand from major markets like China and India

- Central bank purchasing activities

These elements combine to determine whether gold can effectively protect purchasing power during inflationary periods. The interrelationship between these factors creates a complex picture that investors must navigate.

Expert Perspectives

Financial advisors

remain divided on gold’s current effectiveness as an inflation hedge. Some point to its limited industrial applications compared to other

precious metals like silver or platinum, suggesting its value relies more heavily on perception than practical utility.

Others maintain that gold’s limited supply and universal recognition still make it an essential component of a diversified portfolio, particularly during

uncertain economic times.

“What we’re seeing now is gold responding to a mix of inflation expectations and real interest rates,” notes one financial analyst. “When real rates are negative, as they often are during high inflation, gold typically performs well.”

As economic data continues to emerge, investors will watch closely to see if gold prices maintain their traditional relationship with inflation measures or if new patterns emerge in this economic cycle.

The coming months will likely provide clearer signals about whether gold can fulfill its historical role as a store of value during inflationary periods or if

alternative investments might prove more effective for preserving purchasing power.