As Gaza’s war grinds on, paper cash is wearing thin and the banking system is barely functioning, leaving families trapped between digital balances and empty wallets. Residents describe a system where money exists on screens but not in their hands, and where payments rely on scarce electricity and unreliable internet. Two friends, one in Gaza and one in Belgium, are testing whether funds sent abroad can be accessed on the ground. Their experience shows the daily hurdles of a

shattered cash economy.

Cash Running Out—and Falling Apart

Israel has restricted the

flow of physical currency into Gaza since the fighting began. That means the only bills in circulation are the ones that were already there. Those notes now pass through so many hands that they are torn, taped, and nearly unusable.

“Israel has been blocking the flow of physical money into Gaza since the start of the war,” one account explained. “So whatever paper cash was in Gaza before the war, that’s all that’s been circulating.”

Residents say even finding small change can take hours. Many shops no longer accept larger bills because they cannot break them. Prices are volatile, and cash-only trade fuels bartering for basics like bread, fuel, and medicine.

Banks Shut, ATMs Silent

Formal banking is largely out of reach. Branches are closed, ATMs are offline, and power cuts make digital systems hard to use. Even when people have money in their accounts, accessing it is another story. “How does money even work in Gaza right now?” asked host Sarah Gonzalez, capturing the confusion of an economy without functioning tools.

Without reliable ATMs or card terminals, people fall back on trusted shopkeepers, family networks, and small informal lenders. Some merchants run tabs for long-time customers. Others accept partial payments or goods in trade. These arrangements keep food moving but push many into debt.

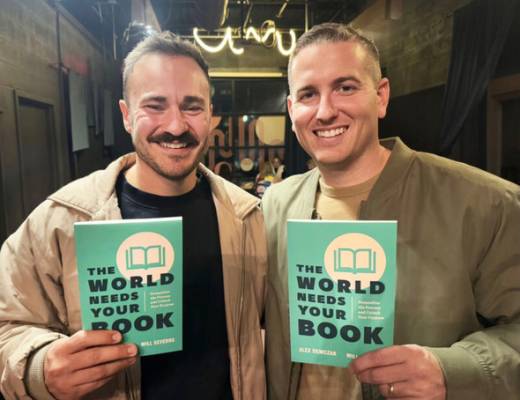

A Cross-Border Lifeline Attempt

Against this backdrop, two best friends—one in Gaza, one in Belgium—are trying to send money in. Their plan is simple in theory: transfer funds to a Gaza

bank account and withdraw cash locally. In practice, each step is uncertain. Wire transfers can land, but withdrawals depend on a branch or agent that is open, powered, and supplied with banknotes.

“Two best friends, one in Gaza and one in Belgium, are now trying to get money in,” a producer said, describing the effort to turn digital funds into usable cash.

They look for workarounds. A relative who knows a shop owner might cash out a portion of the transfer for a fee. A

small exchange office might convert funds if it has notes on hand. Fees can be steep. Verification steps require mobile service that often cuts out. The process can take days.

What People Can Still Buy

Even when cash appears, supplies are thin and prices change quickly. Food staples and fuel are the priorities. Medicines, batteries, and building materials are scarce and expensive. Many stores

operate reduced hours to save generator fuel. Refrigerated goods spoil during outages, so sales skew to shelf-stable items.

- Cash is preferred for essentials like bread and vegetables.

- Informal credit fills gaps when families run short.

- Service fees for cashing out digital funds eat into purchasing power.

Why Digital Fixes Fall Short

Mobile payments, prepaid cards, and bank transfers depend on power, networks, and confidence that funds can be redeemed. In Gaza, each piece is fragile. Without a steady flow of new banknotes,

digital balances cannot meet cash demand. People hesitate to accept digital transfers if they are unsure how to turn them into food or fuel.

Gonzalez pressed the core issue: when banks, ATMs, and the grid fail at once, even basic payments become complex. Her question—“How do you get that money out, in Gaza, when there are no functioning

banks or ATMs?”—remains the central challenge.

The friends’ experiment offers a window into a broken payment chain: money sent abroad can arrive on paper, but it rarely becomes paper in Gaza without risk, delay, and high cost. Until fresh currency enters and key services resume, families will rely on worn bills, personal trust, and improvised credit. The immediate future will hinge on whether more cash can enter safely, whether power and networks stabilize, and whether small traders can keep goods on shelves. Observers will watch for any sign that formal banking can restart—or that informal workarounds become the new normal.