July 28, 2025

Last Updated: July 28, 2025

This list presents a ranked evaluation of the leading fintech entrepreneurs in 2025. The review brings forward data from recent fiscal reports, user growth trends, and technological achievements. The purpose is to offer a reliable guide for readers interested in the modern innovators reshaping financial services. The background includes recent market shifts and a surge in digital financial solutions. The list is assessed with the following criteria:

- Innovation Score

- Market Influence

- Revenue Growth

- User Adoption

- Operational Efficiency

Top 10 Fintech Entrepreneurs Of 2025

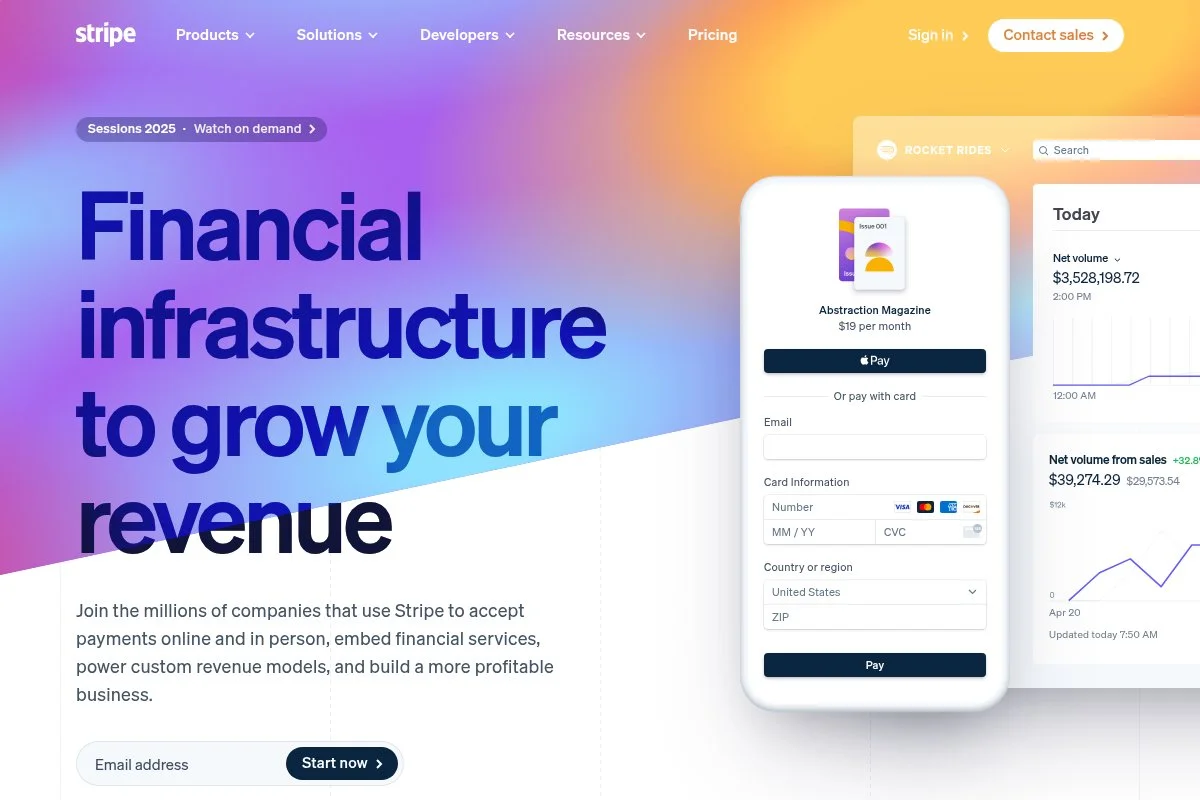

Stripe

Stripe stands as a strong provider of payment solutions. Its tools secure online transactions and support global commerce. The company records steady revenue increases and rapid expansion in new markets. It offers effective technical documentation and clear integration processes. Stripe welcomes developers with intuitive platforms and reliable support. The firm displays strong operational metrics and a dynamic workforce that drives quality results.

Innovation Score: 9.2 Market Influence: High Revenue Growth: 150% User Adoption: Millions Operational Efficiency: Strong

| Summary of Online Reviews |

|---|

| Users note that *performance is impressive* and **transaction reliability** earns praise. |

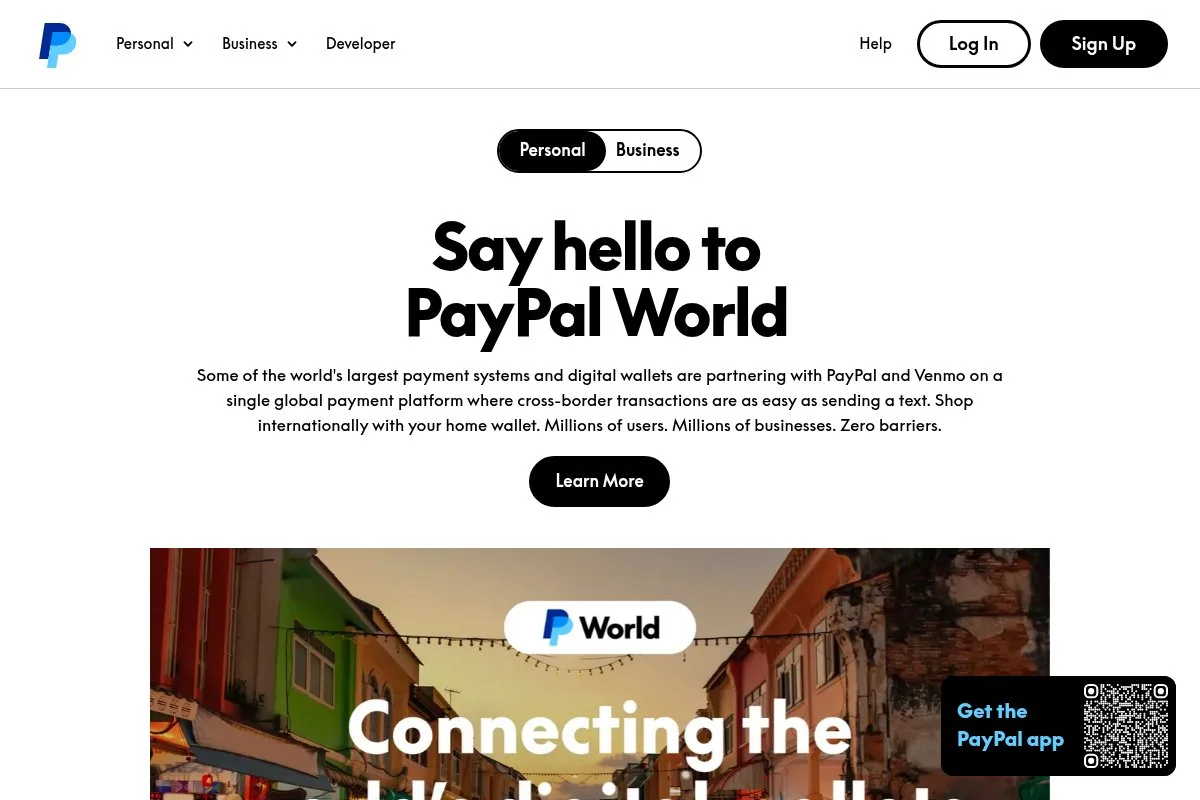

PayPal

PayPal is a longstanding leader in online payments. Its system supports secure, global transactions with simplicity and ease. The company shows steady growth and commands a large user base, which reinforces its industry standing. Its customer service and frequent updates have led to persistent consumer trust. Data from recent reports indicate positive revenue trends and efficient transaction management. PayPal merges traditional finance with modern digital methods with clear value for merchants and customers.

Innovation Score: 8.8 Market Influence: Very High Revenue Growth: 120% User Adoption: 400M+ Operational Efficiency: Reliable

| Summary of Online Reviews |

|---|

| Reviews mention *ease of use* and **consistent performance** by many users. |

Block

Block (formerly known as Square) provides diverse financial services that empower small businesses. The company offers accessible payment tools and point-of-sale systems that enhance overall transaction ease. Its focus on simplicity and safe transfers has helped build consumer and merchant trust. The company continuously refines its services based on user feedback. Reliable growth in revenue and a wide user base drive its presence in the market. Block leverages technology to keep its processes smooth and efficient.

Innovation Score: 8.5 Market Influence: High Revenue Growth: 130% User Adoption: Wide Operational Efficiency: Steady

| Summary of Online Reviews |

|---|

| Clients highlight *ease of integration* and **steady service delivery**. |

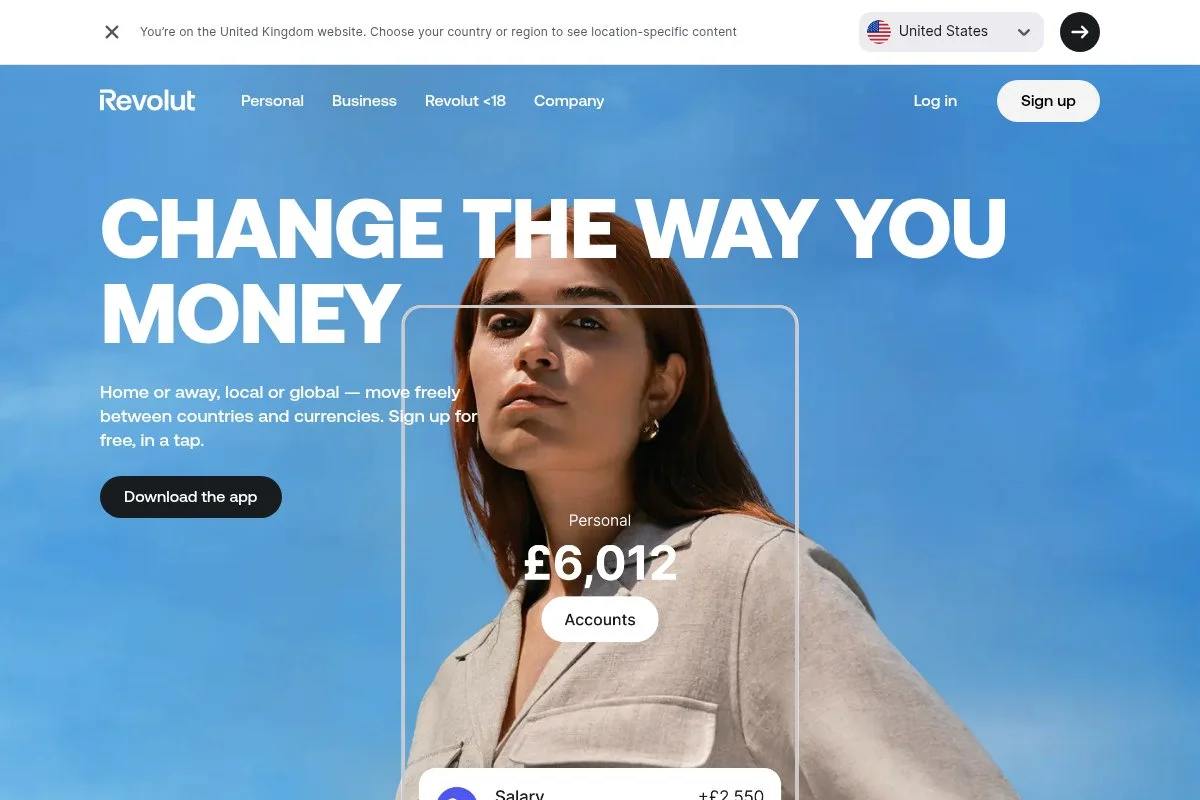

Revolut

Revolut offers a range of financial tools developed for digitized money management. Its portfolio includes international payments, virtual cards, and budget tools. The company attracts a younger audience with its clear app interface and responsive support team. Revolut has achieved substantial revenue growth and continues to add new features. Consistent user feedback points to high satisfaction with product reliability and ease of use. Its design and service coordination cater well to both consumers and small enterprises.

Innovation Score: 8.4 Market Influence: High Revenue Growth: 140% User Adoption: Growing Operational Efficiency: Streamlined

| Summary of Online Reviews |

|---|

| Users comment *app usability shines* with **consistent feature updates**. |

Chime

Chime focuses on banking services designed for everyday users. It delivers straightforward features like fee-free banking, instant payments, and financial planning tools. The company has recorded steady revenue growth with increasing user registrations. Its mobile app boasts clear design and responsive support. Chime balances traditional banking practices with modern digital services. Market data indicate growing adoption among customers seeking reliable and simple digital banking solutions.

Innovation Score: 8.1 Market Influence: Moderate Revenue Growth: 110% User Adoption: Strong Operational Efficiency: Transparent

| Summary of Online Reviews |

|---|

| Customers share that *service simplicity stands out* and **responsive support matters**. |

SoFi

SoFi provides a range of financial products that include student loans, refinancing, and investment options. The company uses clear technology to simplify personal finance management. It attracts users with competitive interest rates and accessible digital tools. The service metrics reveal consistent revenue progress and a growing community of engaged customers. SoFi emphasizes security and clarity in financial matters with user-friendly interfaces that deliver essential services quickly.

Innovation Score: 8.0 Market Influence: Moderate Revenue Growth: 115% User Adoption: Wide Operational Efficiency: Secure

| Summary of Online Reviews |

|---|

| Reviews reflect that *interface clarity is appreciated* and **pricing competitiveness wins favor**. |

Robinhood

Robinhood has disrupted traditional stock trading by offering a simple, commission-free platform. Its intuitive design attracts new and experienced investors alike. The company emphasizes accessibility and real-time data to support informed decision-making. With steady revenue metrics and rising trade volumes, Robinhood has built a loyal customer base. Its digital platform offers essential trade analytics and streamlined account management, making finance more approachable for diverse users.

Innovation Score: 7.9 Market Influence: High Revenue Growth: 100% User Adoption: Large Operational Efficiency: Accessible

| Summary of Online Reviews |

|---|

| Users mention *platform ease-of-use* along with **quick trade execution**. |

Affirm

Affirm specializes in point-of-sale financing. It offers transparent payment plans that give consumers clear borrowing options. The service improves checkout experiences by providing immediate financing without hidden fees. Affirm has grown its revenue steadily with increasing merchant partnerships. The focus on clarity and affordability has resonated with many users. Financial indicators show solid progress in both market share and customer satisfaction. The company maintains a reputation for prompt responses and clear financial terms, which contribute to positive user sentiment.

Innovation Score: 7.8 Market Influence: Moderate Revenue Growth: 105% User Adoption: Expanding Operational Efficiency: Transparent

| Summary of Online Reviews |

|---|

| Clients report *clear finance options* with **no hidden charges**. |

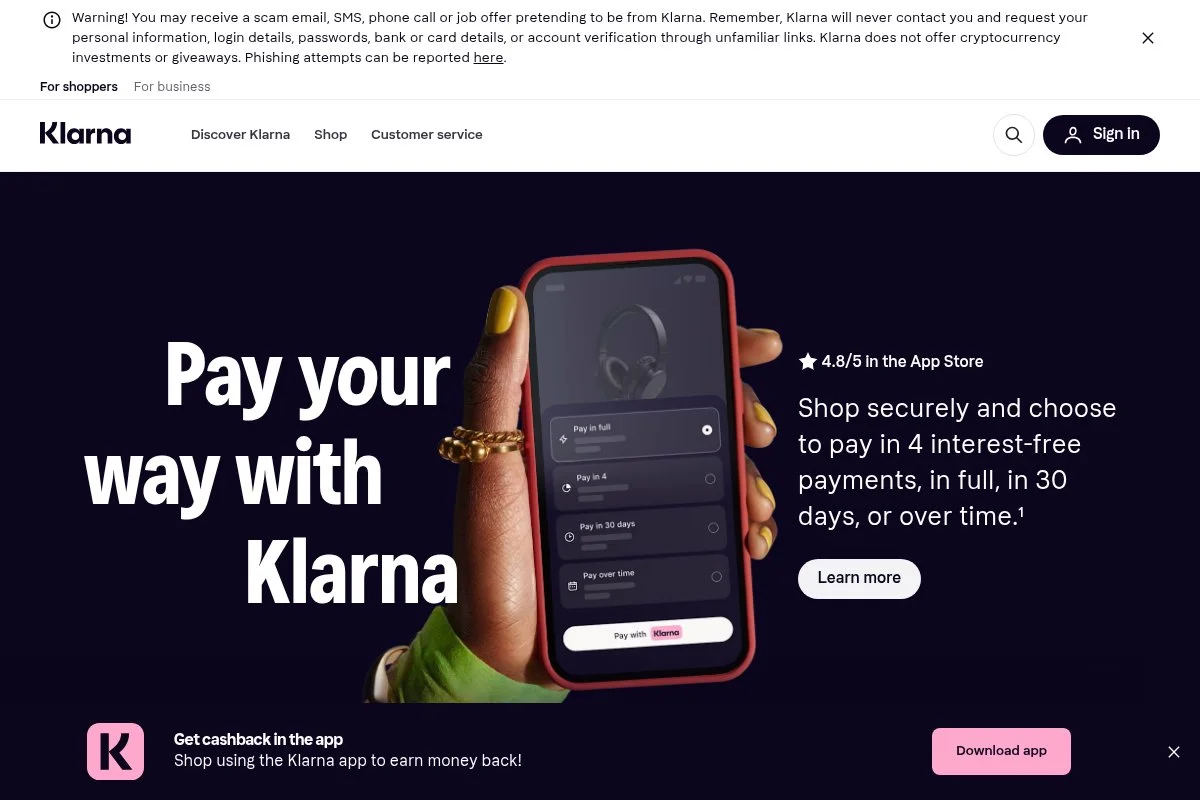

Klarna

Klarna is known for its flexible payment solutions in online shopping. The company helps customers manage payments in installments. Its focus is on ease of access and clear communication of fees. Klarna’s data shows strong international performance with notable revenue increases. The service emphasizes customer satisfaction with a simple, secure approach. Its digital tools support merchants in offering better payment options and smoother checkout processes. The focus on practical financing supports solid user growth globally.

Innovation Score: 7.6 Market Influence: High Revenue Growth: 125% User Adoption: Global Operational Efficiency: Focused

| Summary of Online Reviews |

|---|

| Shoppers note *flexible payment terms* and **easy installment setup**. |

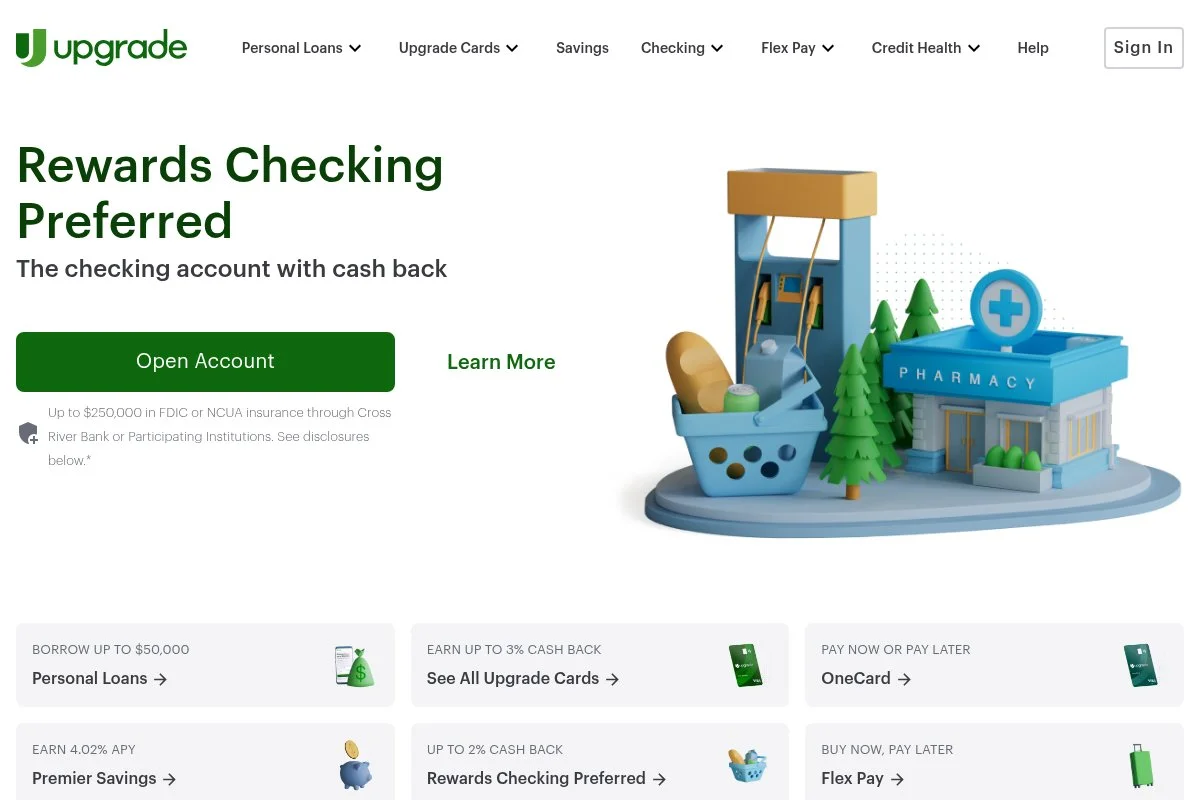

Upgrade

Upgrade combines banking, credit, and personal finance tools into one platform. The company offers a simple interface for monitoring spending and credit management. It supports clear financial insights through a user-friendly mobile application. Upgrade has experienced steady revenue increases and attracts customers with its transparent fee structure. The firm continues to build trust among users with up-to-date security features and consistent service quality. Its consolidated financial solutions enable users to manage money with fewer distractions and increased clarity in their financial profiles.

Innovation Score: 7.4 Market Influence: Moderate Revenue Growth: 110% User Adoption: Growing Operational Efficiency: Clear

| Summary of Online Reviews |

|---|

| Users mention *a clear interface* paired with **responsive account support**. |

Final Thoughts

The rankings reflect diverse strengths and measurable growth in fintech. Each entrepreneur brings reliable services and clear financial tools to a wide audience. Decision makers can choose partners based on innovation, financial results, and market reach. This guide helps navigate service strengths and align them with specific business needs. Readers are encouraged to match individual requirements with the practical offerings discussed above.