What 'softer' trade deal between US and Vietnam signals for markets? Nikunj Dalmia decodes | Editor's Take@nikunjdalmia #USVietnam https://t.co/Nn82eyHlMI

— ET NOW (@ETNOWlive) July 3, 2025

The stock market saw significant movement on Wednesday as President Donald Trump announced a trade deal between the U.S. and Vietnam. Despite concerns raised by a new report showing a surprising decrease in private payrolls for June, the S&P 500 managed to close at a record high. The S&P 500 gained 0.47%, closing at 6,227.42, while the tech-heavy Nasdaq Composite advanced 0.94%, finishing at a record 20,393.13.

The Dow Jones Industrial Average, however, slipped slightly by 10.52 points, or 0.02%, ending the day at 44,484.42.

#MarketAlert | Wall Street hits record highs as Trump’s Vietnam tariffs & tax megabill stir the pot ahead of key US jobs data! ???

#StockMarket #Trump #Nasdaq #SP500 #JobsReport #USMarkets #WallStreet #TradeWar #Economy pic.twitter.com/569v030WOp

— ET NOW (@ETNOWlive) July 3, 2025

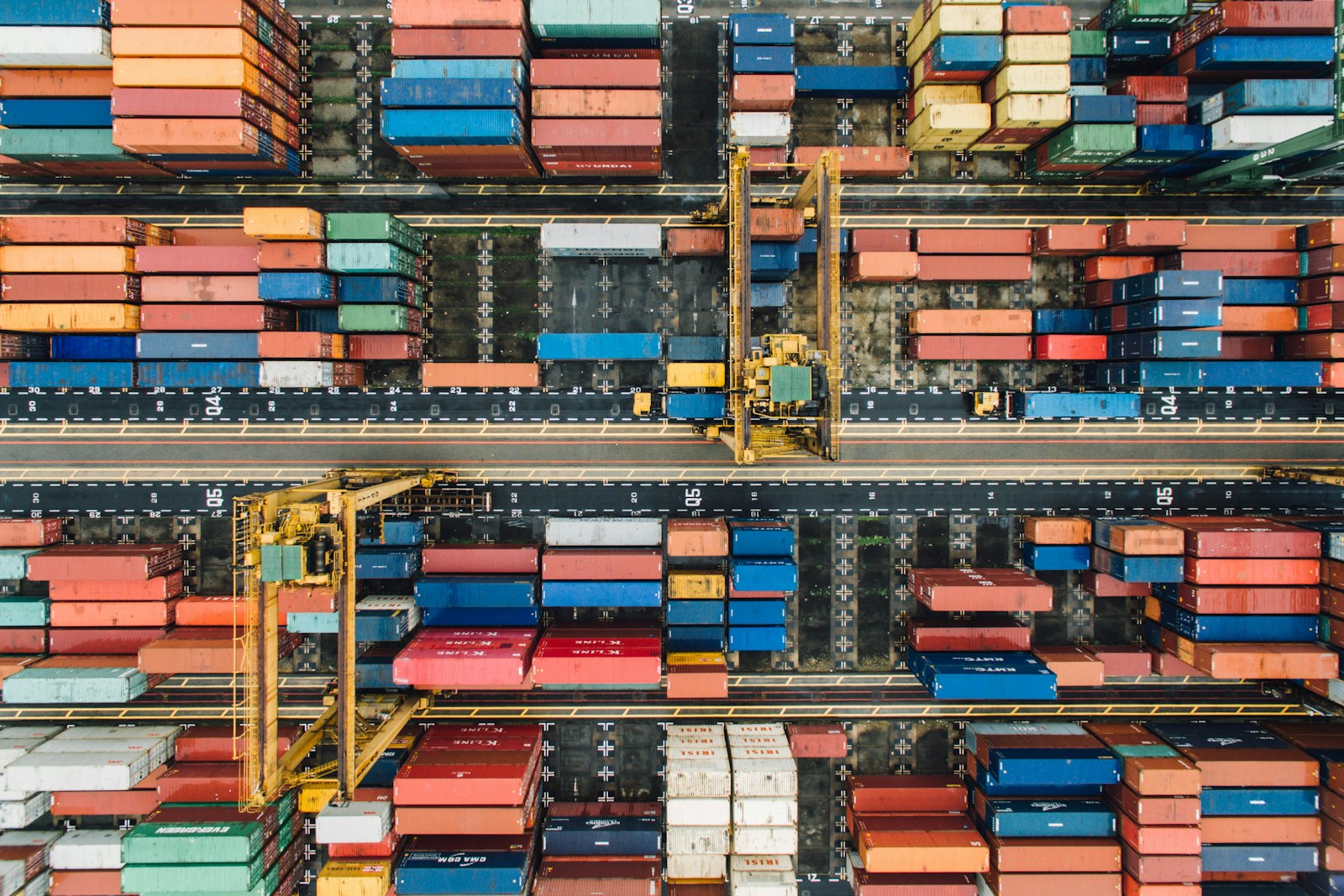

The trade deal announced by Trump includes a 20% tariff on imports from Vietnam, which led to a rise in shares across Vietnamese and Chinese markets by 4%. Despite the positive market reaction, earlier in the day, the markets experienced some pressure following the latest ADP report, which showed a decline in private sector jobs for June.

This marked the first monthly decline in ADP’s payroll report since March 2023. Economists had expected payrolls to grow by 100,000.

“The U.S. stock market ended the first half of 2025 with back-to-back record highs, defying a rollicking few months of trade tensions and economic uncertainty that sent it deep into negative terrain in April.” https://t.co/BxPoPeQs2I

— Andrew Ackerman (@amacker) June 30, 2025

“We have been seeing a weakening of the labor market for months, and I always wondered if it would take a negative payroll print to get the Federal Reserve to pay more attention to the labor market as opposed to inflation,” said Ross Mayfield, investment strategist at Baird.

The ADP report has historically been unreliable in predicting the government’s monthly nonfarm payrolls report, due out Thursday, where economists anticipate growth of 110,000 jobs for June. If the nonfarm payrolls also fall short of expectations, it might prompt a Federal Reserve interest rate cut later this month. Current market expectations for a rate cut have increased, with traders seeing a roughly 23% chance of a cut at the July meeting.

Trade deal impacts markets

Traders also monitored President Trump’s tax-and-spending bill, which narrowly passed the Senate on Tuesday. The bill’s path through the House remains uncertain due to hold-outs among GOP lawmakers.

The ADP report highlighted significant job losses among small businesses. Companies with fewer than 20 employees saw a net loss of 29,000 jobs in June. In contrast, larger businesses with more than 500 employees recorded a 30,000 increase in payrolls.

“The job loss concentrated in small businesses is meaningful given their role as primary drivers of employment in the country,” added Ross Mayfield from Baird. Health care company Centene experienced its worst day on record after withdrawing its full-year guidance for 2025. Shares plummeted more than 39% on Wednesday, marking the worst performance in the stock’s history and a 43% decline year-to-date.

Robinhood’s stock surged over 7% amid speculation that it could soon be added to the S&P 500 following the closed acquisition of Juniper Networks. Analysts believe Robinhood is a strong candidate to fill the slot left open by Juniper. Cryptocurrency-related stocks saw gains, reflecting increased interest in the crypto sector, particularly in stablecoins and tokenization supported by the Ethereum network.

Companies like Riot Platforms, a bitcoin miner, saw significant increases in their stock prices. Overall, the stock market exhibited mixed responses to various economic indicators and geopolitical developments, with investors closely watching upcoming reports and policy decisions.