FOX Business reporter Ashley Webster delivered key market insights on the popular program ‘Varney & Co.,’ highlighting a stock that has reached an unprecedented high while also discussing new legislation aimed at restricting

Chinese purchases of American land.

The segment covered two major financial stories currently impacting markets and national security concerns. Webster first reported on a notable stock performance before transitioning to the more politically charged topic of

foreign land ownership restrictions.

Record-Breaking Stock Performance

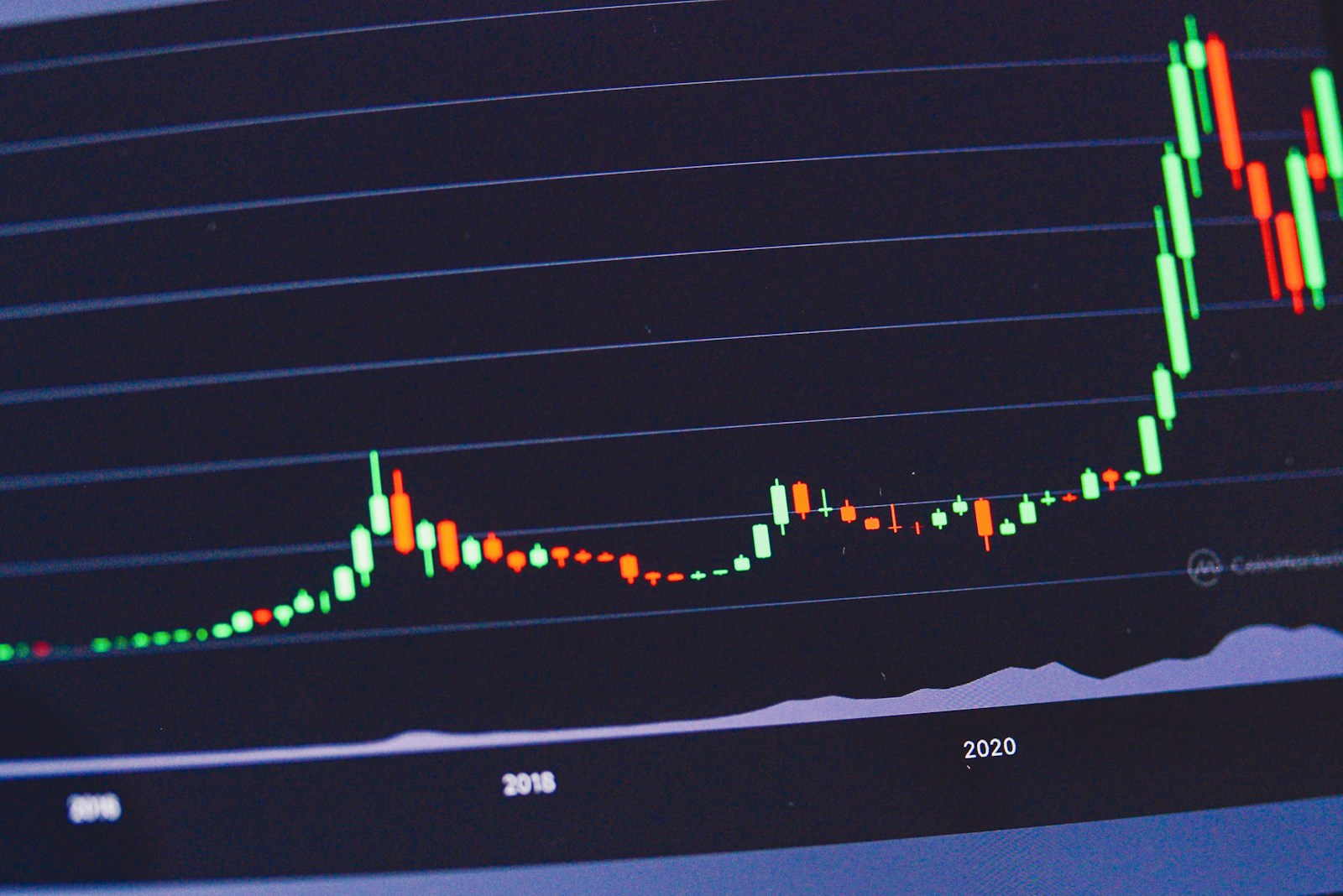

During the broadcast, Webster identified a specific stock that has climbed to an all-time high, though the exact company was not specified in the available information. This market development comes amid ongoing volatility in various sectors as investors navigate economic uncertainties.

The stock’s performance stands out particularly as many companies continue to face challenges from inflation, supply chain disruptions, and shifting consumer behaviors. Market analysts have been closely monitoring such breakout stocks for indications of sector strength or company-specific advantages.

New Legislation Targeting Chinese Land Purchases

The second portion of Webster’s report focused on a newly proposed bill designed to restrict Chinese entities from purchasing land in the United States. This legislation represents the latest development in growing tensions between the U.S. and China over national security and economic concerns.

The bill appears to be part of broader bipartisan efforts to address perceived threats from foreign

ownership of American assets, particularly in sensitive or strategic locations. Similar measures have gained traction in recent years at both the federal and state levels.

Concerns driving such legislation typically include:

- Proximity of foreign-owned land to military installations or critical infrastructure

- Food security implications when foreign entities purchase agricultural land

- National security risks associated with data collection or surveillance capabilities

Growing Trend of Foreign Investment Restrictions

The proposed legislation follows a pattern of increased scrutiny of Chinese investments in the United States. Several

states have already enacted laws limiting foreign ownership of farmland and property near sensitive facilities.

Federal lawmakers have expressed concerns about the national security implications of allowing entities connected to the Chinese government to own land that could potentially be used for intelligence gathering or to gain leverage over American food production.

The Committee on Foreign Investment in the United States (CFIUS) has already expanded its review process for foreign investments, but many legislators argue that additional safeguards are necessary, specifically targeting land purchases.

Economic experts remain divided on the potential impacts of such restrictions. Some

warn that limiting foreign investment could reduce property values in certain regions, while others maintain that national security concerns must take precedence over short-term economic considerations.

The timing of this bill coincides with heightened

diplomatic tensions between Washington and Beijing across multiple fronts, including trade practices, technology transfer, and geopolitical influence.

As this legislation moves through Congress, analysts will be watching closely for potential economic ripple effects and possible retaliatory measures from

China that could impact American businesses operating overseas or further complicate trade relations between the world’s two largest economies.