Every time I mention real estate investing to someone, I hear the same tired response: “That’s risky.” It’s like Ralphie in “A Christmas Story” being told he’ll shoot his eye out with a BB gun. This knee-jerk reaction drives me crazy because it ignores a crucial question: What if the bigger risk is actually where most Americans currently park their money—in Wall Street investments?

Recently, someone commented on my channel that the “S&P 500 is the most diverse, safest investment you could possibly do.” I nearly fell out of my chair! This widespread belief that stocks are inherently safer than real estate deserves serious examination.

The Historical Truth About Risk

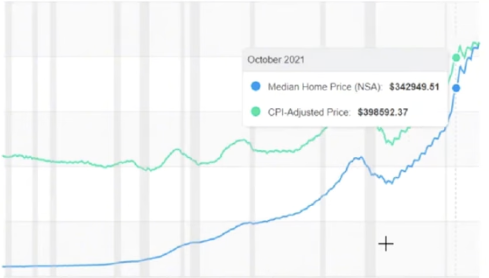

Let’s look at the data. Over the past 70+ years, through seven major recessions since 1970, what happened to real estate values?

- 1970 recession: Real estate values went UP

- 1974 recession: Values went UP again

- 1980 recession: Values increased

- 1981-82 recession: Another increase

- 1990-91 recession: A minor 2% dip, quickly recovered

- 2001 recession: Values went UP

- 2007-09 recession: The only significant drop (about 20%)

That’s right—in six out of seven recessions, real estate either remained flat or increased in value. The only significant drop was during the 2008 financial crisis, when values fell about 20% over four years before recovering.

Now let’s compare this to the stock market during those same periods:

- 1970 recession: S&P 500 dropped 30% in about a year

- 1974 recession: Dropped nearly 50% over two years

- 1980-81 recessions: Relatively flat (the exception)

- 1990 recession: Dropped 14-15%

- 2000-02 recession: Dropped 45% over a couple years

- 2007-09 recession: Dropped over 50%

The pattern is clear. While real estate has shown remarkable stability through economic downturns, the stock market has repeatedly experienced massive drops of 30-50% during recessions.

Recovery Times Matter

After the 2008 financial crisis, real estate took about 9 years to fully recover its value. The stock market? About 13 years to reach the same point. Real estate not only dropped later but recovered faster and gained more value during that period.

Risk is defined as the chance of loss. Based on historical performance, which investment truly carries the greater risk?

When Real Estate Actually Becomes Risky

I’ll concede one point: real estate can be risky when you’re completely ignorant about what you’re doing. If you’re trying to flip houses with no experience or sinking money into properties you don’t understand, then yes—you’re taking on significant risk.

But the same applies to active stock trading. As a former stock coach who taught people how to trade stocks and options, I’ve witnessed people lose far more money in the market than in real estate. One client lost 90% of his money in just days through options trading.

The difference? When you make mistakes in real estate, you typically have time to correct course. When stocks plummet, your money can vanish before you even realize what happened.

The Freedom Factor

Beyond risk considerations, real estate offers something the stock market rarely does: true financial freedom through passive income. While stocks may provide dividends, they rarely generate enough cash flow to replace your income.

Well-structured real estate investments can deliver double-digit returns year after year while providing monthly cash flow that can eventually make work optional. This is the path to freedom that most Wall Street investments simply can’t match.

The next time someone tells you real estate is risky, challenge them to look at the historical data. The numbers don’t lie—Wall Street has consistently been the bigger gamble. You might just be the safe investor while they’re the one rolling the dice with their financial future.

Frequently Asked Questions

Q: Didn’t the 2008 housing crash prove real estate is extremely risky?

The 2008 crash was an anomaly caused by specific factors including appraisal fraud, overbuilding, and predatory lending practices. In the 70+ years of housing data, it’s the only time real estate values dropped significantly (about 20%) during a recession. One major correction in seven decades hardly makes real estate “extremely risky” compared to stocks, which have experienced multiple 40-50% drops during the same period.

Q: What about liquidity? Isn’t real estate riskier because you can’t sell quickly?

While real estate is less liquid than stocks, this characteristic actually protects investors from making emotional decisions during market volatility. The inability to panic-sell during downturns is often a benefit, not a drawback. Additionally, there are many real estate investment structures that offer more liquidity than direct ownership, such as REITs or certain private equity funds.

Q: Don’t stocks outperform real estate in the long run?

The S&P 500 has averaged about 8.4% annually over the past 30 years—not the 10-12% often claimed. When you factor in all the returns from real estate (cash flow, appreciation, tax benefits, and debt paydown), many real estate investments significantly outperform this average. Plus, real estate returns tend to be more stable and predictable compared to the wild swings of the stock market.

Q: How can average people invest in real estate without becoming landlords?

There are numerous ways to invest in real estate passively. You can participate in private lending, join real estate syndications, invest in turnkey rental properties with property management in place, or put money into real estate funds. These options allow you to benefit from real estate’s stability and returns without dealing with tenants or toilets. The key is education and connecting with experienced operators who have proven track records.