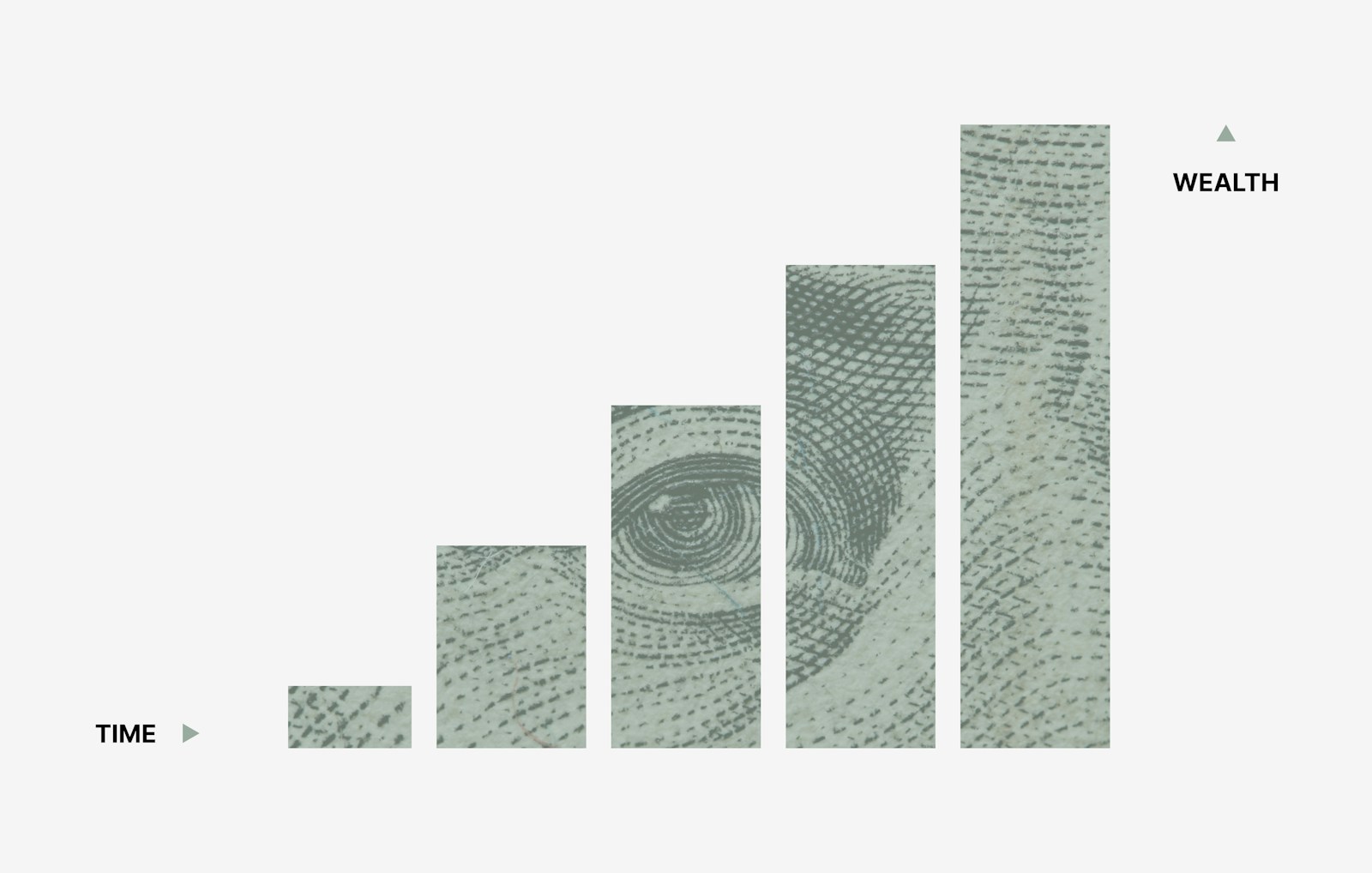

Entrepreneurship today is not limited to launching startups or creating apps. Many young founders are also exploring financial markets as part of their strategy to build wealth. Trading, when done with discipline and knowledge, can complement business income and create another source of growth.

For entrepreneurs who already thrive on making decisions, being adaptable, and taking calculated risks, trading feels like a natural extension. Platforms such as

TradingGuide are trusted resources that help new traders cut through the noise with clear insights and practical market analysis. The real question is not whether young entrepreneurs should trade, but how to begin in a way that protects capital and builds confidence.

Trading and the Entrepreneurial Mindset

Running a business requires resilience and the ability to read fast-changing conditions. These traits translate directly into trading. Both fields demand:

- Risk awareness: allocating capital with limits in place.

- Adaptability: reacting quickly to new information.

- Strategic thinking: spotting opportunities early.

Entrepreneurs who manage budgets, make deals, and handle uncertainty often find trading a familiar experience.

Trading vs. Investing

Before the first trade, clarity is essential. Trading and investing are not the same.

- Investing can build wealth slowly. It involves long-term assets such as funds, bonds, or property. Investors typically rely on compounding returns, reinvested dividends, and steady market growth. This approach is often less stressful because it does not require constant monitoring.

- Trading focuses on shorter periods. Positions can last minutes, days, or weeks, with profits and losses realised quickly. Traders rely on price movements, market timing, and technical signals. While the potential for faster gains exists, the risks are also higher.

Both approaches can play a role in a financial plan. The difference lies in time commitment and attention. Trading requires more active involvement, while investing allows a more passive approach. Many entrepreneurs use investments to build a safety net and trade a smaller amount for growth and learning.

For readers who want to understand the foundations of long-term wealth creation,

beginner-friendly strategies for investing in stocks offer a practical starting point before moving into more active markets.

Picking the Right Market

Entrepreneurs entering trading must choose a market that fits them best. Each market has its own risks and opportunities.

Stocks: Buying shares means owning part of a company. This is often the first choice for entrepreneurs because it feels familiar. Company earnings, new products, and industry trends all affect stock prices.

Forex: The currency market runs 24 hours a day and has very high liquidity. It attracts traders who want quick access and global reach. Currency pairs often move on interest rates, central bank actions, and political events.

Commodities: Oil, gold, and farm products rise and fall with global supply and demand. They can protect against inflation and bring diversity to a portfolio.

Cryptocurrency: Digital assets move quickly and carry high risk. Still, they are gaining wider use. They appeal to entrepreneurs who like technology and can handle volatility.

The best way to begin is with one market, not many. This focus helps you see how prices move, which news matters, and how to control risk. Once confident, you can expand into other areas.

Learn Before You Trade

Jumping in with real money is one of the most common mistakes. Knowledge and practice must come first.

Key areas to study include:

- Market structure: Learn how orders are placed, matched, and executed. Understanding liquidity and spreads is critical.

- Technical analysis: Price charts reveal patterns of support, resistance, and momentum. They help traders identify entry and exit points.

- Fundamental analysis: Earnings, interest rates, and economic data all influence prices. A trader who understands these drivers has an advantage.

- Risk frameworks, including position sizing, stop-loss orders, and diversification, are essential tools for survival.

Practical preparation matters as much as theory. A demo account or trading simulator lets you practise strategies without risking capital. It also helps build discipline and test ideas in real time.

Treat this stage like developing a business plan. Just as no entrepreneur would launch a start-up without research and testing, no trader should risk capital without proper preparation.

Risk Management Above All

Success in trading is not about winning every position; it’s about managing risk effectively. It is about keeping losses small and letting gains add up. Entrepreneurs already know that one failed project does not sink a business if costs are controlled.

Key habits include:

Treat trading like its own business unit. With rules in place, growth becomes more sustainable.

Using Technology

Entrepreneurs are quick to adopt new tools. This gives them an advantage in trading. Mobile platforms, alerts, and advanced dashboards make monitoring easier. The same mindset used to track customer data or marketing performance can be applied to trading analytics.

The focus should be on tools that add clarity and efficiency, not unnecessary complexity.

Controlling Emotions

Markets move fast, and emotions can take over. Even skilled professionals feel the pressure of fear and greed. Entrepreneurs who have faced setbacks may be more resilient, but trading tests discipline in new ways.

Helpful practices include:

- Writing rules before entering a trade and sticking to them.

- Accepting losses as part of the process.

- Avoiding rash decisions after a winning or losing streak.

- Seeing trading as part of a long-term plan, not a daily scorecard, keeps emotions under control.

Trading as Part of a Larger Plan

Trading should be part of a wider plan, not the only focus. Young entrepreneurs gain more when they use a mix of approaches.

- Core investments build steady long-term growth.

- A smaller trading account creates room for short-term opportunities.

- Cash reserves or low-risk assets provide security in uncertain times.

This balance reduces risk while still allowing for growth. Entrepreneurs

seeking practical ways to combine long-term investing with active trading can explore smart investment strategies for young entrepreneurs, which highlight methods to build wealth sustainably while managing risk exposure.

Final Thoughts

Trading is not a quick way to get rich. It is a discipline that needs patience and preparation. Young entrepreneurs already use these skills when building their companies.

Start with knowledge. Control risk. Treat trading like a business. This approach creates another path to financial growth. Both business and trading depend on the same core strengths: managing uncertainty, spotting opportunities, and building systems that last.

Photo by Morgan Housel; Unsplash